is preschool tuition tax deductible 2019

If you paid for a babysitter a summer camp or any care provider for a disabled child of any age or a. If two or more children are enrolled in preschool you will be eligible for a maximum of 6000.

Your Us Expat Tax Return And The Child Care Credit When Abroad

Typically preschool expenses were only counted toward a child and dependent care credit and not a education credit or expense.

. Line 21400 was line 214 before tax year 2019. That legislation ended this tax break. Is preschool tuition deductible.

Parents of incoming Montessori preschool students often ask if their childcare expenses are tax deductible. The tuition and fees deduction was on unsteady footing after the passing of the Tax Cuts and Jobs Act TCJA in 2017. Preschool and day care are not tax deductible but you can be entitled to credits instead.

The answer is no but parents can apply for a tax credit if they. The deduction for tuition and fees expired on December 31 2020. No the tuition and fees deduction which you may have used for the 2019 or 2020 tax year has not been extended.

Ad Answer Simple Questions About Your Life And We Do The Rest. Their adjusted gross income for 2019 was 30000. Tuition for preschool and K-12 is a personal expense and cannot be deducted.

If you make tuition payments directly to the educational institution this would include private school tuition for kindergarten through twelfth grade there is no gift tax or. File With Confidence Today. If youre studying for a qualified degree you could find that youre entitled to the Tuition and Fees DeductionThat means that you can.

However taxpayers who paid qualified tuition and fees in 2018 2019 and 2020 could claim a maximum. So is college tuition tax deductible. Depending on your income your credit is 20-35 of your childcare expenses up to 3000 or 1050 and 20-35 of childcare.

You can contribute up to 2000 a year to a Coverdell ESA. This credit cannot exceed 6000 as per 2019 IRS guidelines. From Simple To Complex Taxes Filing With TurboTax Is Easy.

Heres what financial and tax experts want parents of preschoolers to know. But your money grows tax-free while its in the account. Can I Deduct Preschool Tuition On Taxes.

File With Confidence Today. You can withdraw all of. The subtraction is not allowed for amounts paid for private school.

In 2019 Sam and Kate had childcare expenses of 2600 for their 12-year-old child. Since at least if one or both. Information to help determine the child care expenses deduction you can claim.

Your contributions arent tax deductible. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. Of the 2600 they paid 2000 in 2019 and 600 in 2020.

Also 40 percent of the. The subtraction is limited to 4000 for tuition paid for an elementary pupil and 10000 for a secondary pupil. The IRS allows you to deduct certain childcare expenses on your tax return.

Valid for an original 2019 personal income tax return for our Tax Pro Go service only. It is a tax credit of up to 2500 of the cost of tuition certain required fees and course materials needed for attendance and paid during the tax year. If the dependent attended a school that qualifies for the deduction for elementary and secondary school tuition and the expenses are 9000the deduction allowed is 4500.

From Simple To Complex Taxes Filing With TurboTax Is Easy. The child care tax credit is available to children who otherwise. The official tax receipt or form you received from your educational institution will indicate the amount of eligible tuition fees that you paid for that calendar year.

Has the tuition and fees deduction been extended to 2021. Ad Answer Simple Questions About Your Life And We Do The Rest. However you may qualify for the child and dependent care.

To qualify the fees you paid. The credit is based on a sliding scale. The cost of private school including tuition cannot be deducted.

How Do I Claim The Childcare Element Of Universal Credit Low Incomes Tax Reform Group

Your Us Expat Tax Return And The Child Care Credit When Abroad

David John Marotta S Early Money Memories Memories Marotta Money

Child Care Provider Invoice Template Childcare Provider Invoice Template Contract Template

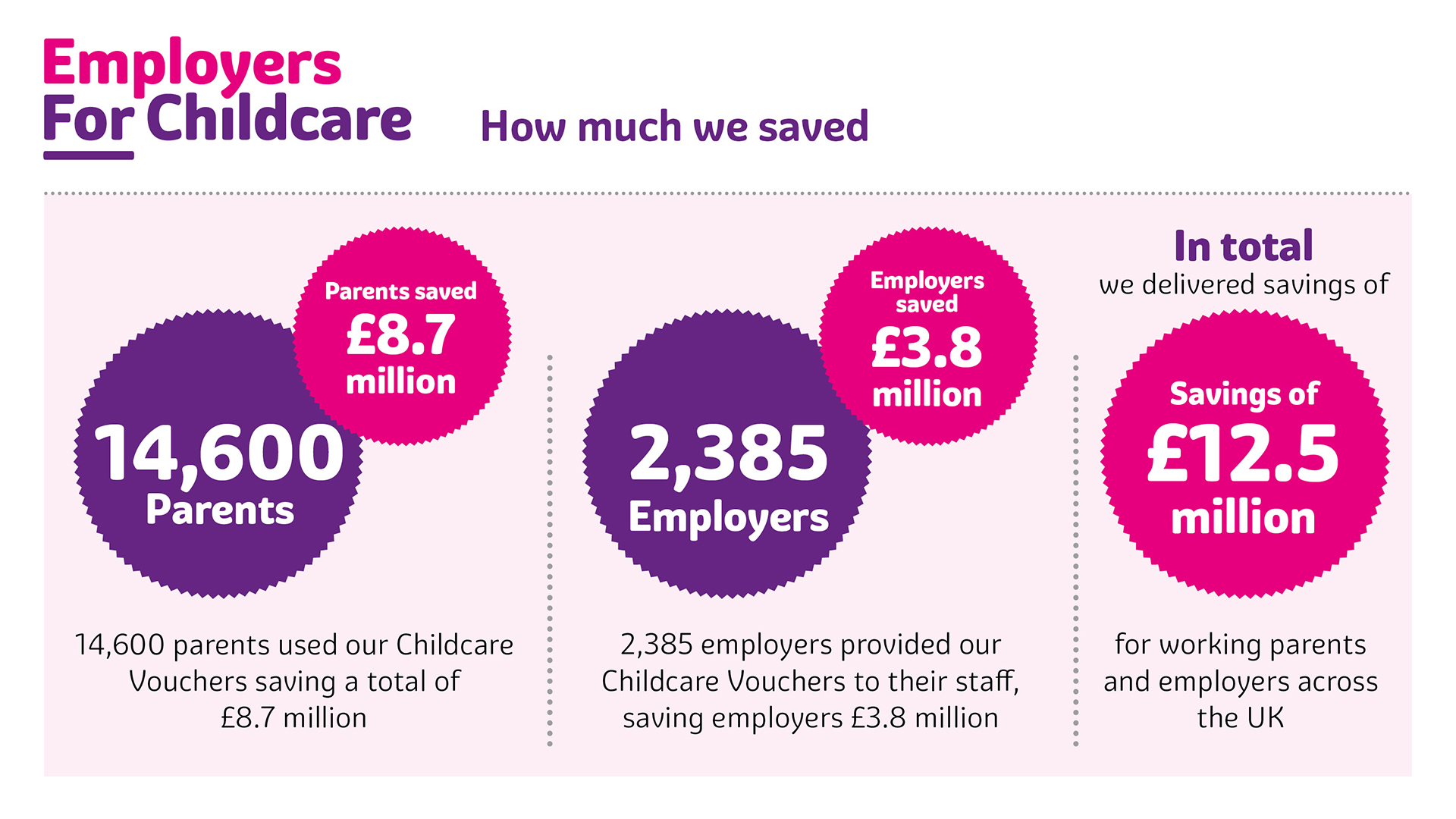

How Do Childcare Vouchers Work Employers For Childcare

Is Preschool Tuition Tax Deductible Motherly

Dentons 2018 Ontario Budget Analysis

Section 80c 80cc Deductions Income Tax Deductions Under Chapter Vi For Ay 2021 22 Tax Deductions Income Tax Income Tax Return

8 Simple Ways To Reduce The Costs Of Paying For Private School Fees The Money Panel

Some Back To School Expenses Could Be Tax Deductible The Motley Fool

Is It Tax Deductible 7 Things Parents Should Know Before They File Parents